What Does the Merger of BBVA and PNC Mean for You and Physician Mortgage Loans?

Once upon a time, it was difficult for doctors just out of medical school to qualify for traditional mortgages. This was because most young medical professionals have sky-high debt loads and not much credit history. Along the way, someone came up with the ingenious idea of harnessing medical professionals’ inherent strengths by offering physician mortgage loans. These physician loans make it easier for doctors to buy their first residence, allowing them to experience the exquisite joy of homeownership early on in their medical careers.

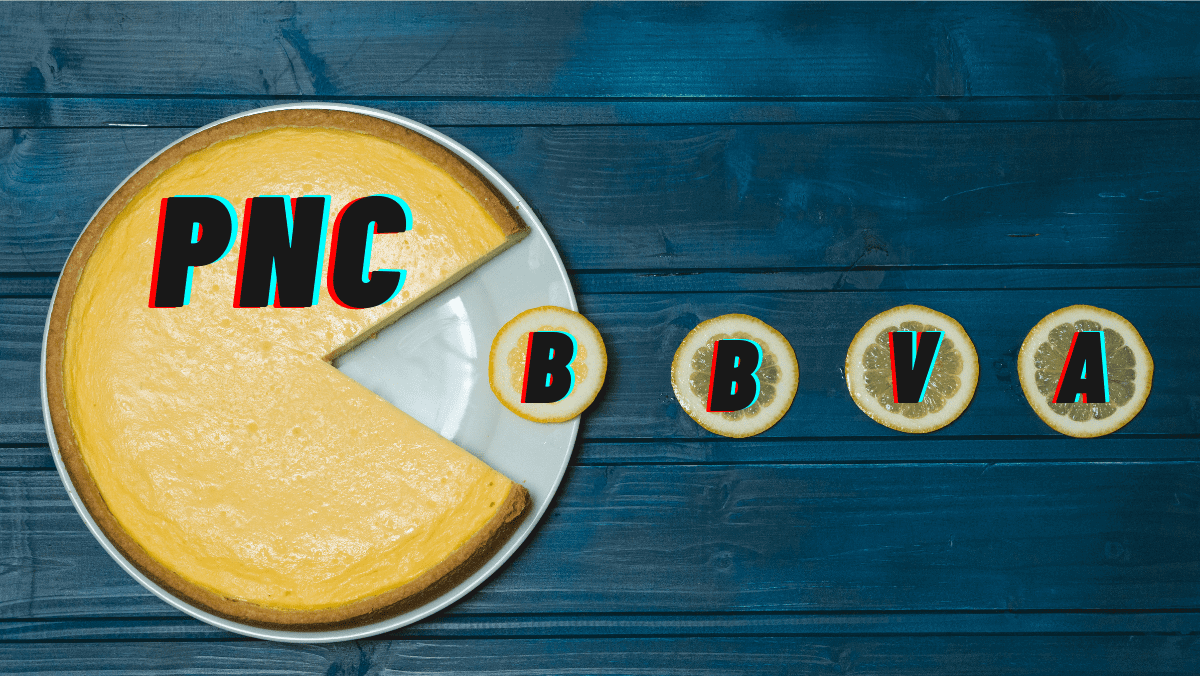

The Merger of BBVA and PNC

If you’re a doctor looking for one of these loans, we’ve got some important news to tell you.

BBVA Compass, a recognized leader in physician home loans, is merging with PNC, a bank with its headquarters in Pittsburgh, PA. The deal has been resoundingly approved by both companies’ boards of directors. It is expected to be finalized in the middle of 2021. Here is BBVA press release.

For physicians looking to buy a home, that’s potentially bad news.

That’s because PNC has made it clear that they intend to get rid of the physician mortgage loans BBVA currently offers. This will cause an unfortunate shrinking of the physician mortgage lending market, making it more competitive.

Less competition means that terms aren’t going to be as favorable.

Physician mortgage loan shoppers are going to need to be more vigilant than ever!

How to Get the Best Physician Mortgage Loan Rates

The best way to stay on top of all the ever-changing landscape of physician mortgage lending, so you always get the best rates is by reading our blog.

By doing that, you’ll learn everything you need to know to get good deals when it comes to getting a mortgage.

The Advantages of Physician Mortgage Loans

Remember that even with fewer competitors, physician mortgage loans are almost always a better deal than conventional loans if you’re a doctor.

For example, unlike most conventional loans where you must plunk at least 20% down, a physician mortgage loan requires either no money down or a small down payment.

Most banks offering conventional home mortgages force you to buy private mortgage insurance. With a physician home mortgage loan, you’re not bound by this requirement because of the low risk of default posed by doctors.

This also results in lower down payments and savings of up to 1% on yearly mortgage fees.

That’s a $10,000 a year savings on a one-million-dollar home!

Another reason to go with a physician mortgage loan is it can be challenging to find a lender for those who’ve just finished medical school and have massive debt.

With conventional loans, the massive debt you incurred in acquiring a medical education is counted against you when the bank does its calculations. Banks that offer physician home loans realize you shouldn’t be penalized for all those years you spent investing in yourself.

Physician home mortgage lenders recognize that most doctors end up being high earners. Because of this, they’re willing to forgo some of the usual prerequisites. All this allows you to move forward with getting the housing you need without complications from a typical home loan.

Drawbacks to Physician Loans

There are a few drawbacks to physician loans.

Rates and fees on these loans can be a little higher than loans that require a down payment and years of being employed by the same company.